Godafoss Long-Term Innovation Growth Fund (the "Fund") seeks long-term growth of capital by investing primarily in established public companies in domestic markets only. Investment opportunities are generally evaluated based on Godafoss' estimation of future growth prospects of the business and the market segments it operates in. Investments are primarily made in common stocks.

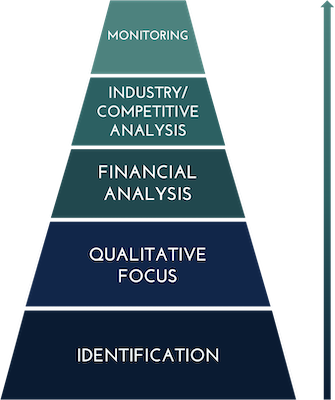

Contact UsPortfolio companies are typically selected based on a bottom-up fundamental analysis, aiming for capital appreciation from both revenue and earnings growth over the long term. The Fund generally chooses to invest in businesses that it perceives to have strong management teams and a proven market presence.

This investment process is predicated on Godafoss' rigorous diligence in seeking to identify exceptional companies that, in our view, are trading at significant discounts to their intrinsic value.

The description herein of the approach of Godafoss and the targeted characteristics of its strategies and investments is based on current expectations, is subject to change, and should not be considered definitive or a guarantee that the approaches, strategies, and investment portfolio will, in fact, possess these characteristics. In addition, the description herein of the Fund's risk management strategies is based on current expectations, is subject to change, and should not be considered definitive or a guarantee that such strategies will reduce all risk. These descriptions are based on information available and reasonably believed to be accurate as of January 17, 2024, and the description may change over time. Investing involves risk, including the risk of loss of principal. Past performance of these strategies is not necessarily indicative of future results.